A Look into the Future: How Do I Calculate my FIRE Number?

8-minute read.

Are you tired of the daily grind and hoping to have enough money to retire early?

Have you dreamed of a life where you can be financially independent, pursue your passions, and spend time with loved ones without worrying about the constraints of work?

Welcome to the world of FIRE, the Financial Independence Retire Early movement that is sweeping the globe!

To achieve this goal, you'll need to work out your FIRE number, which is the amount of money needed to support your desired lifestyle without relying on traditional employment.

In this article, we'll guide you through the FIRE calculator step by step, so you can start planning for the future you truly deserve.

Get ready to take control of your finances and discover your path toward early retirement!

Table of Contents

The banner ads and some links in this blog post are affiliate links. This means that, if you click on a link and join, I may receive a referral commission at no extra cost to you. All opinions remain my own and each company featured is individually selected.

How is the FIRE number calculated?

Finding out your FIRE age requires a thorough understanding of your current spending and future lifestyle goals. Here's a breakdown of the basic steps involved in a FIRE calculator:

-

Determine your annual spending: The first step is to calculate your current yearly expenses. This includes everything from housing costs, food, transportation, taxes, healthcare, entertainment, and any other recurring overhead.

Although budgeting can be difficult and frustrating to create and follow, our blog post on the 50-30-20 budget rule is a great starting point for those looking to get their finances in order.

-

Factor in future inflation: Keep in mind that the cost of living increases every year due to inflation. According to the U.S. Bureau of Labor Statistics, the average annual inflation rate over the past decade (pre-covid) has been around 1.8%.

Start planning for your retirement today. Visit our go-to resources page and find companies that will help you build a nest egg and reach your fire goal.

-

Estimate your retirement spending: Consider the lifestyle you want to lead during retirement. Will you travel frequently, eat out often, or have any other hobbies or interests that require additional expenses? Estimate these costs and add them to your predicted yearly spending.

Having an emergency fund is one of the most important things you can do for your financial well-being. Read How Much Cash Should I Have On Hand?

-

Multiply by 25: The rule of thumb with the early retirement calculator is to multiply your annual expenses by 25 to determine your FIRE number. This assumes that you'll be withdrawing 4% of your investments portfolio annually during retirement, as annual income.

This fixed percentage guideline creates a debate amongst certified financial planners; more on this in The Biggest Problem with the 4% Retirement Savings Rule, and How You Can Fix It.

Here's an example to illustrate how the fire calculator works:

Let's say your current annual expenses are $50,000.

You estimate that you'll need $10,000 extra money annually for travel and hobbies (in today's dollars).

Factoring in 1.8% inflation, your total estimated annual expenses for retirement would be $64,414.

To calculate your FIRE cost, you would multiply this amount by 25, resulting in a total of $1,610,350.

Here's a table to summarize the example:

By following these steps and accounting for your personal lifestyle goals, you can determine your unique FIRE number and start planning to retire early.

How much do you need for early retirement using FIRE?

The amount of money you need for the FIRE movement varies depending on various factors such as your current age, net worth, retirement savings rate, life expectancy, and income growth rate for example.

However, a common rule of thumb is to save 25 times your annual expenses to comfortably reach fire without relying on a full-time job.

For example, if your estimated annual spending is $50,000, you would expect to save $1,250,000 to achieve your FIRE goal.

This assumes a safe withdrawal rate of 4%, which means you could take out 4% of your portfolio annually to cover your expenses during retirement.

It's important to note that the 25 times fire calculator guideline is not a one-size-fits-all approach, but it is certainly an objective you can set for yourself.

Your FIRE number also depends on your targeted retirement age, asset allocation and expected future returns, passive income (if any), lifestyle expenses, and the annual growth rate of your investments.

Related Blog Post: Is it Really Possible to Retire at 30?

Simple FIRE calculation

The earlier your FIRE age, the more money you will need to retire early.

Those who no longer have a mortgage on their primary residence and/or expect to receive business income or real estate income will get a head start and would need fewer savings to reach FIRE.

Start growing your nest egg today and learn how to make enough passive income with our 37 easy passive income ideas.

Here is a simpler method to estimate your fire number based on current dollars:

FIRE Number = (Annual Expenses - Any Pension or Social Security) / Safe Withdrawal Rate

Safe Withdrawal Rate = 4% (the average rate you can withdraw each year without running out of money)

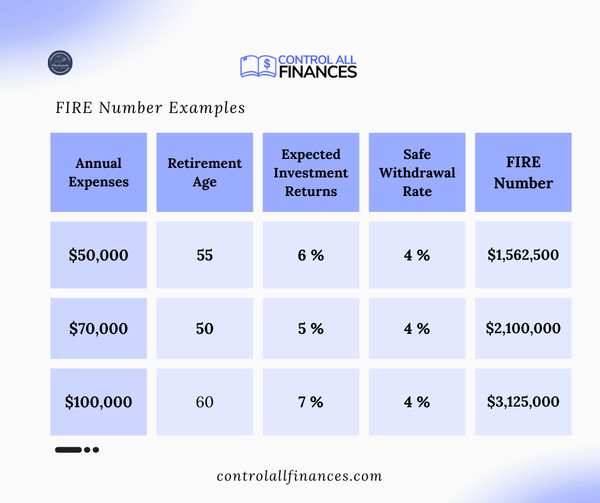

For example, let's say your yearly expenses are $50,000 and you plan to retire in 20 years at age 55.

You estimate a safe withdrawal rate of 4% and expect to earn a 6% annual return on your investments.

Your FIRE number can be calculated as follows:

FIRE Figures = ($50,000 / (1-0.04)) x 25

FIRE Number = $1,562,500

In the table below, you can see a breakdown of the calculation and how it changes based on different variables:

It's important to consult with a financial advisor to ensure you are making the best decisions for your specific financial goals and needs.

You can also practice the fire factor yourself with this calculator from WalletBurst.

Building a successful investment portfolio can be intimidating, but it can be done simply and efficiently with model portfolios. Risk-averse investors will stick to safer investments whilst those with a higher risk tolerance will build an aggressive portfolio with other asset classes.

What is a good FIRE number?

A good FIRE number is the amount of money you need to accumulate in your retirement accounts to cover your annual spending when you retire. The following are some stats, facts, and figures popular with the FIRE movement:

The 4% Rule:

The 4% rule is a commonly used rule of thumb for those looking to achieve FIRE. It suggests that you can withdraw 4% from your investments in the first year of retirement, and adjust the amount for inflation each year thereafter. This way, based on income growth rate and past performance, your portfolio is likely to last for 30 years in retirement.

Recently, with the uncertain social security administration, taxes, the prospect of decreased pension income, and retirees' need for their savings to last longer, several financial planners have revised the average rate of investment withdrawal. They now recommend that 3.3% is a more realistic amount to take out to cover your annual spending.

Also, depending on your current age and your planned retirement age, you may need more money and a nest egg lasting more than 30 years.

The Trinity Study:

The Trinity Study is a landmark study published in 1998 that analyzed the sustainability of withdrawal rates in retirement. The professors looked at historical stock market performance, interest rates, and bond returns. It found that the 4% withdrawal rule is likely to provide enough annual income and that your retirement savings would last 30 years, even during periods of market volatility for your investments.

Save & Invest with the Acorns app, which offers a variety of features, products, and free learning resources. Acorns is a mobile and web-based platform that aims to help you save for the future by rounding off your purchases and investing the difference in low-cost ETFs. Control All Finances readers can claim a $20 bonus investment.

Compound Interest:

Compound interest is a powerful tool for achieving financial independence. The earlier you start saving and investing, the more time your money has to grow, and the less you need to save each year.

For example, if you start saving $200 per month at age 25 and earn an average return of 8% per year, you could accumulate over $600,000 by age 65.

Your savings rate today is a key factor to retire early. Someone who saves less but starts earlier would end up with a higher net worth than somebody who invests more but started later.

Your Lifestyle:

Your FIRE number will depend on your way of life and spending habits. If you plan to live a frugal lifestyle in retirement, you will need less income than if you plan to retire, travel the world, and live a luxurious lifestyle.

Geographic Arbitrage:

Geographic arbitrage is another strategy that can help you retire faster. By moving to a lower-cost-of-living area, you can reduce your expenses and require less money to achieve financial independence. We look at rental properties and passive income in Real Estate Investing in the Philippines.

To summarize, a good FIRE number will depend on a variety of factors, including your lifestyle, savings habits, investment returns, and geographic location.

The following table provides an example of how much you would need to save to achieve financial independence, with the same amount but based on different withdrawal rates and annual spending:

Remember that the above fire movement table is just a starting point as your circumstances, investment performances, and income requirements may vary.

How do I calculate how much FIRE I need?

To calculate how much FIRE you need, you can follow these steps:

-

Decide on your withdrawal rate: Once you have determined your annual expenses, you need to decide on your withdrawal rate. This is the percentage of your investment portfolio that you plan to withdraw each year to provide income and cover your expenses. The most commonly used rate is 4%, but some people may choose to use a higher or lower rate depending on their circumstances.

-

Calculate your FIRE number: To calculate your FIRE number, you need to divide your annual expenses by your withdrawal rate. For example, if your annual expenses are $40,000 and you plan to use a 4% withdrawal rate, your FIRE number would be $1,000,000 ($40,000 ÷ 0.04).

-

Adjust for inflation: It's important to consider inflation when calculating your FIRE number for retiring early. Inflation can erode the purchasing power of your income over time, so you may want to adjust your annual spend and increase your savings to account for inflation.

-

Consider additional factors: Your FIRE number may also be affected by other factors such as your current net worth, life expectancy, potential future spend (such as healthcare costs), stock market or investment returns, and any other sources of income you may have (such as rental income or social security).

Conclusion

Calculating your FIRE number is an important step in achieving financial independence retire early.

It's important to consider your net worth, annual expenses, inflation, desired income, and other factors that may affect your circumstances.

While the 4% withdrawal rule is a commonly used guideline, it's always best to do your research and consult with a financial advisor before making any investment decisions.

By taking the time to calculate your FIRE number and creating a solid financial plan, you can work towards achieving your financial goals and retire comfortably.

We're passionate about helping people reap the rewards of saving & investing wisely. So we want to know: what’s YOUR fire number? Let us know in the comments below!

With the right knowledge & tools in hand, there's no telling how far you'll go - so get started on building your future today!

Contributor: Akhlaq Mushtaq Qureshi

Related reads on Financial Independence Retire Early

At Control All Finances, we want to help you navigate through the tricky worlds of retirement planning, debt management, savings, and investing. We’ve got your back when it comes to smart money decisions!

So whether you’re new to the world of finance, or a seasoned pro, we invite you to peruse our articles and let us be your guide through the often bumpy financial terrain.

Guidelines with annual expenses

-

Monthly Savings: It's Not as Difficult as You Think

-

5 Simple Tips for Organizing Your Finances in 2023

-

10 Easy Ways to Pay Off Debt

Grow your money

-

eToro Review: The Platform Pioneering Social Trading

-

Fractional Shares: What It Is, Why It Matters, and How To Invest

-

What is Equity Multiple? Invest Smarter and Maximize your Rental Properties Returns

Retire early

-

Financial Freedom vs. Financial Independence: What's yours?

-

5-Step Formula to Achieve your Financial Independence

-

Ask Me Anything: 5 Answers to Your Questions About How to Be Financially Successful

-

Why the Biggest "Myths" About Fat FIRE May Actually Be Right

Control All Finances eBooks

-

Start your journey with How To Achieve Your Financial Independence eBook

-

Ways to achieve wealth in the Develop Your Financial IQ eBook

-

Money-saving tips in our Summer Savings eBook

Don't let financial stress hold you back - regardless of your net worth or how far you are from retirement - let us guide you towards a journey to financial independence!

Control All Finances Blog was selected by FeedSpot panelists as one of the Top 100 Investment Blogs on the web.

No Financial Advice. This article does not provide financial advice and has been prepared without taking into account any person’s investment objectives, financial situation, risk tolerance, or particular needs.